Global Macro Fund

The Golden Horse Global Macro Fund is anchored by a robust proprietary quantitative model that drives asset selection, allocation and portfolio optimisation. The model determines optimal allocation of capital across assets based on the best risk adjusted returns to maximise long term growth. This ensures that investment decisions are objective, bias-free and nimble. We may deviate from our quantitative model during black swan events such as the Covid-19 Pandemic.

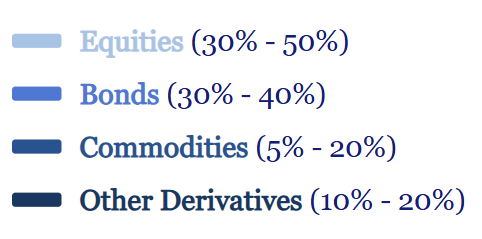

Asset Class Exposure

- Equities (30% - 50%)

- Bonds (30% - 40%)

- Commodities (5% - 20%)

- Other Derivatives (10% - 20%)

- Disclaimer

These figures are a rough indication of minimum and maximum allocation levels. They are dynamic and changes according to market conditions.

Key Statistics

0

%

Targeted Returns

0

%

Targeted Volatility

0

Sharpe Ratio

0

Sortino Ratio

- Disclaimer

Returns are calcuated using LTM figures and subsequently annualized (as at June 2025). More detailed performance figures available upon request.

Key Pillars of Our Approach

Proprietary Model Training

Proprietary Model Training

Leveraging extensive data sources, our model has been built by quantitative researchers and technologists. This model has undergone rigorous back testing and scenario analysis with a feedback loop to ensure continual improvement.

Real Time Access To Data

Real Time Access To Data

We continue to invest heavily in data sources; capturing economic, fundamental, market and alternative data. Through advanced modeling techniques, daily exposure levels can be adjusted dynamically depending on market volatility.

Strong Risk Management

Strong Risk Management

We invest across a diverse range of asset classes and utilise hedging strategies to reduce exposure to market risks. We have a strong emphasis on managing downside risks, as seen from our Sortino ratio.

Latest Insights

Previous

Next

Latest Insights

Previous

Next

Proprietary Model Training

Proprietary Model Training Real Time Access To Data

Real Time Access To Data Strong Risk Management

Strong Risk Management